Think about the volume of data you have at your fingertips. Investment research. Macroeconomic reports. “Social signals” from your clients. Now, how well do you feel you are able to bring all that data together, real time, to the benefit of your clients? Daunting, isn’t it?

Many advisors would likely compare their experience working with the massive amounts of data available to them to juggling. It can feel impossible to keep that many balls in the air. They simply don’t have access to a consolidated view of their clients, are often saddled with tools and systems that don’t work well together, and must switch between numerous applications just to service their clients. It’s inefficient at best … and a huge headache at worst.

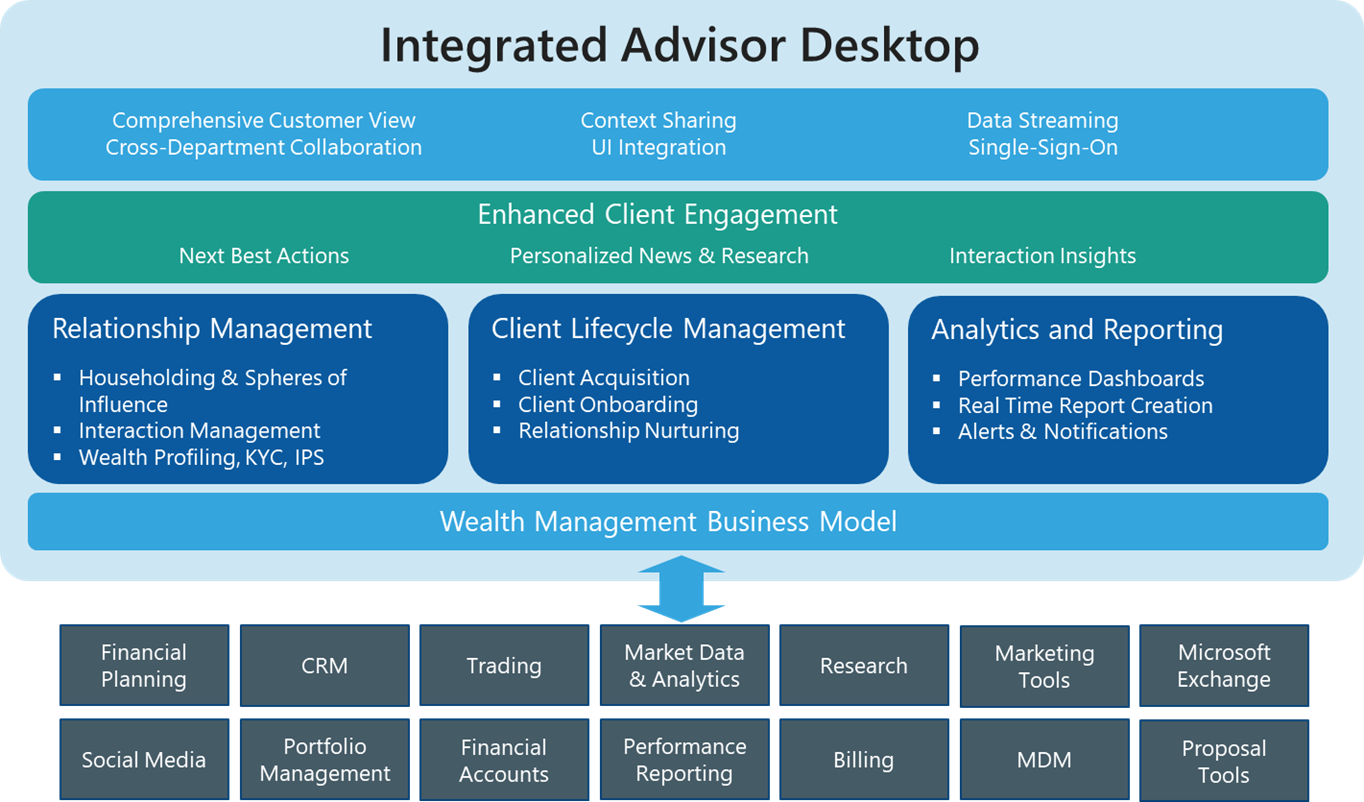

This is where a true integrated advisor desktop can make all the difference for advisors. An integrated advisor desktop is a single, seamless interface that is designed to manage and encourage proactive client engagement, personalize service, and automate day-to-day tasks. It offers a unified view of all client information, providing advisors with a single point of truth by consolidating information across multiple sources.

In its recent report about NexJ, Celent spells out the need for this type of solution: “Clients’ experience in adjacent industries, such as tailored solutions and engagement, serves as a prism for their expectations within the wealth management space. Analyzing millions of data points to deliver actionable insights to the advisor is the difficult task at the heart of successful client engagement.”

Simply put, integrated advisor desktops are needed to help advisors better engage with customers and drive those relationships. A report by the Investments & Wealth Institute on Canadian High-Net-Worth investors found that 86 percent of clients who said they were engaged in the client-advisor relationship were extremely likely to continue working with their advisor. Only 45 percent of clients who said they did not have an engaged relationship were extremely likely to continue working with their advisor.

Specifically, integrated desktops are designed to help advisors with:

- Relationship Management - An integrated desktop must include capabilities to help advisors better understand their clients, their clients' households and spheres of influence, including tracking interactions. Many firms use generic CRM tools, such as Salesforce or Dynamics, to do relationship management, but they don't help with householding or investor-specific profiling.

- Client Lifecycle Management - Understanding the customer is not enough. An advisor also needs capabilities to service the client with onboarding, KYC reviews, new account opening and relationship nurturing. To do this effectively, advisors need technology that walks them through specific processes and leverages data that is already contained in the desktop. In other words, advisors should never have to gather the same information twice.

- Analytics and Reporting - Advisors need access to client data, dashboards and the ability to create their own reports. A good integrated desktop has advisor-centric data reporting, tools and alerts, and notifications that are triggered based on data events.

Importantly, the modern integrated desktop also enables enhanced client engagement, meaning it makes suggestions for how advisors can improve their business without making specific demands for that information. More specifically, through advanced AI, an integrated desktop should analyze for next best actions and recommend what the advisor should be doing now to improve the client experience.

NexJ’s solution

The reality today is that most integrated advisor desktop platforms are “horizontal toolsets,” meaning they help with capabilities such as context passing and UI integration, but other capabilities are left to third-party systems or in-house development. It’s a fragmented and often frustrating experience for advisors.

NexJ has designed its integrated advisor desktop specifically for wealth management firms. It combines vertical-specific functionality, such as householding, investment profiles, and KYC, with the ability to house all client-centric information advisors need to fully understand their customers, collaborate with team members, and ultimately better serve clients. NexJ’s offering harnesses AI to provide next best actions, interaction insights, and personalized news and research fine-tuned for wealth management firms and their clients.

The bottom line is advisors need to get more out of an integrated desktop than they are putting in. An intuitive, AI-driven integrated desktop specifically designed for wealth management can make that desire a reality.

RBC Wealth Management Finds Success with NexJ’s Integrated Advisor Desktop

As one of the world’s 10 largest wealth managers, RBC serves clients with a full suite of banking, investment, trust, and other wealth management solutions. To efficiently bring all of those offerings together, RBC needed a best-of-breed integrated desktop for their wealth management operations, one that would enable them to attract and retain top talent, increase advisor productivity, and deliver a comprehensive view of client households. RBC chose NexJ not only because of our deep experience in wealth management, but because we engage with our customers as a strategic partner.