Successful financial advisors have to live in two worlds: They need excellent strategic awareness of their entire book of business and macro-trends in the markets and industry, while at the same time maintaining personal relationships with each of their many clients and translating those macro-trends into meaningful action for unique individuals.

In designing the NexJ Integrated Advisor Desktop (IAD) solution, the need to support advisors at every level led to the development of several distinct dashboard views. Each of these dashboards seamlessly unifies data and input from multiple sources and, more importantly, uses AI and advanced analytics to relate the data from these sources to each other.

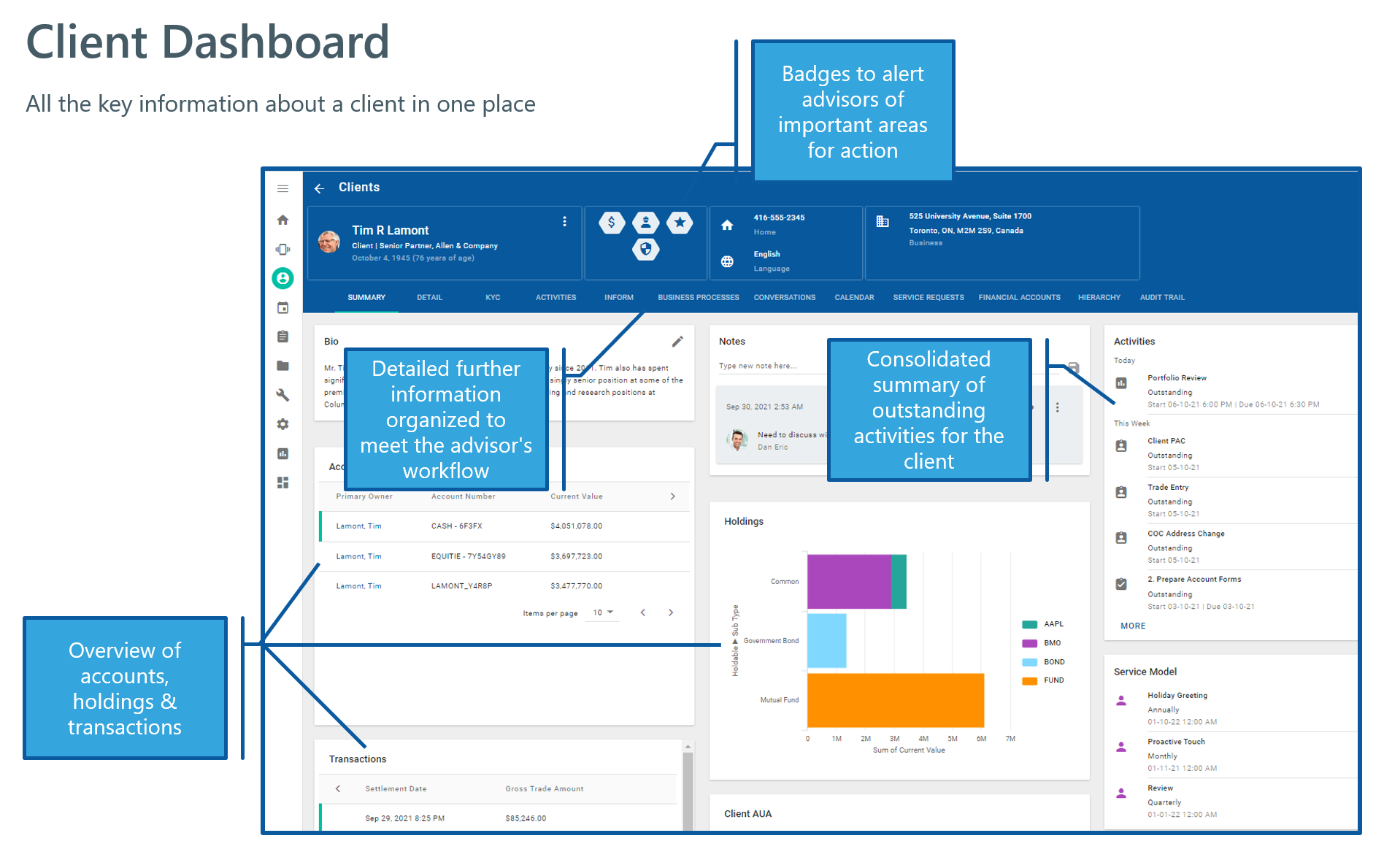

To apply the insights provided to a specific client, NexJ developed a Client Dashboard to bring the advisor’s focus to the level of the individual. Like all components of the NexJ IAD, this dashboard is accessible via any connected device, and centralizes all the critical systems an advisor uses to eliminate inefficient application-switching and manual data-porting, and surfaces insights, recommendations and next-best actions the system surfaces by analyzing all the available data.

Features and Benefits of the Client Dashboard

Focusing all that insight and capability on a specific client greatly increases an advisor’s ability to offer personalized service. Here are some of the capabilities found in the NexJ Client Dashboard:

- Advanced search: The launchpad for this tool allows the advisor to search for and bring up specific clients, households or legal entities within their book, or search using segmentation elements of the client profile (age, wealth level, service level, or clients who are invested in registered plans or specific securities.)

- Detailed workspace: Advisors can work with each client, household or legal entity in the way that makes the most sense for them. The dashboard brings in relevant information on additional household members, for example, and factors that information into its analysis.

- Process launchers: The most-needed tools and processes are a click away. Advisors can launch processes for the client in question, collaborate with internal team members, support functions and product specialists.

- Interaction and client service tools: The advisor can also start a voice or video meeting with their client, screen share and collaborate on documents directly from the dashboard.

Benefits to the advisor and organization

With these powerful, focused tools in the hands of every advisor in an organization, there are benefits at every level.

- Clients get more focused, personalized attention and a better user experience, including the level of digital support and interaction they expect from a modern financial advisor

- Advisors are more efficient and organized, better able to offer the level of personalized care they want to give each client, while also gaining the ability to serve more clients and maximize the value of each relationships.

- Advisory firms rise with the increased success of their advisors. These tools also make it easier to acquire and onboard new clients, and because they help advisors succeed, can even help attract and retain advisors.

Through the Client Dashboard and the other functions of the NexJ IAD – the Advisor Desktop, Engagement Desktop and Analytics & Reporting Dashboard – advisors are able to effortlessly shift between all the different roles they need to master to be successful. And that ability to do their jobs better means more clients who will successfully achieve their financial goals – the ultimate measure of success.