Some of you may be familiar with Next Best Action in the context of Sales & Marketing, where the consideration is which offer is most appropriate for which customer at a point in time. Extending Next Best Action to customer service seems a natural progression, considering the service representative is already engaged with the customer, and presuming the interaction went well, means extending the dialog with an appropriate offer.

But how do we extend this to optimizing interactions at the point of service dispensation?

This year, we have seen Morgan Stanley apply Next Best Action to improve Financial Advisor interactions with their customers by recommending timely and appropriate product recommendations. This is more involved than the traditional cross-sale made through existing support channels. Before a product can even be offered to a customer a vast array of choices needs to be considered to ensure that the offered product is materially acceptable, does not trigger any compliance alarms, and is profitable to the organization.

Let’s examine these complexities from an analytics perspective. First, we consider the Marketing Next Best Action as a constrained-based business process optimization problem seeking to maximize revenue. To this we can apply constraints to avoid the compliance alarms. Product offerings must be within the acceptable risk tolerance of the customer and within their investment horizon and knowledge. Complex investment instruments may frighten those with little investing experience and even simple investment instruments in an industry or sector that the customer does not understand are not likely to be well received.

Optimistically we desire a single model that analyzes customer profile information, transaction behaviour, market events, portfolio holdings, compliance documents, and provides a singular entry. Sadly, in practice this is simply not the case. Optimization often reveals many solutions to a singular problem and when data from differing sources are combined, different models or different techniques need to be applied. Imagine if you will, many different answers being provided depending on the nature of the question being asked.

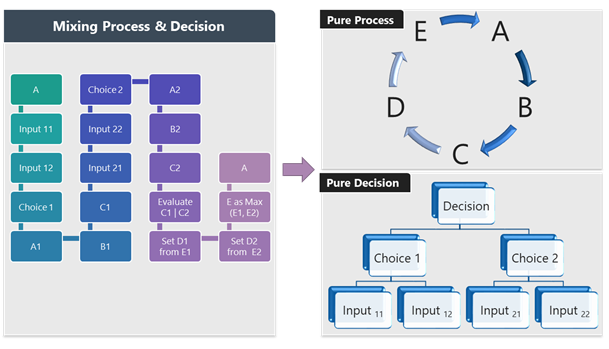

Harnessing these algorithms and monitoring their outcomes are a baseline to continuous learning, but does this mean additional efforts, coding, and validation too? Foundational to establishing continuous learning processes are decision models: the business logic aspects of a business process model. Process models which attempt to encapsulate both procedure and business logic in a single model are complex and hard to maintain. Moving the business logic into a portable, top-down readable model of its own – the decision model – leaves the process model as pure procedure illustrated in the diagram below.

Decision models provide the binding between the affected business process and one or more algorithms. Algorithm results need to be measured and evaluated based on improvements or gains to an understood process with existing outcomes. Each decision model can call one or more algorithms as needed, as required, or as the associated business rules dictate. Should no algorithm be capable of providing a credible result, credible defined as statistically trustworthy, than a rule based algorithm can be invoked. A rule based algorithm can be used to establish a foundation and is especially useful when little or no historical data is available.

Decision models can remove many of the operationalization challenges associated with algorithm implementation, and when combined with sufficient levels of pre-defined process glue, can reduce the time to implement, support, and maintain provided solutions. It also makes it appear to the user community that a singular Next Best Action is offered from a singular source – the actual complexity and process is removed from them.

How does your organization use Decision Models? How do you implement feedback loops? We welcome your thoughts, value your insights, and would love to hear you on social!